tax liens in georgia for sale

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Tax lien sale homes and tax deed sale homes.

The next Tax Sale is Tuesday Sept.

. Tax sale certificates can provide. Online pre-registration is available until Sept. The same applies to tax liens.

Puts your balance due on the books assesses your. If you are new to the tax sale real estate industry we welcome you. Further the North.

Additionally the Virginia Department of Taxation denied a taxpayers request to correct an assessment that disallowed the taxpayers claim that a partnership sale gain was nonbusiness income to be allocated to a state other than Virginia see Virginia Dept of Tax Rulings of the Tax Commissioner No. Statutory Liens on Houses and Other Property. Once scheduled for a tax sale only the following forms of payment are accepted.

All payments are to be made payable to DeKalb County Tax Commissioner. We have provided several resources to help you make well informed decisions when it comes to investing in tax liens or tax deeds at auction. When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector.

Every tax delinquent property is compiled together in a ledger that can be called by many names. The agencies stopped. The Riverside County Tax Collector offers the option to pay property tax payments online and by automated phone call.

A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Best Regards The Search Quarry Team. Foreclosure listings in every state and every status from start to finish with new foreclosed homes for sale updated daily throughout the US.

The lien protects the governments interest in all your property including real estate personal property and financial assets. With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money. Tax Liens.

Tax Sale Scheduled for Tuesday Oct. For more detail read about different types of liens. Its public record too.

There are two types of tax sale homes. Credit From sales tax paid to other state if applicable. Thats the key to this real estate investment strategy.

Cancellation of Liens - The Department will cancel a state tax execution when the delinquent tax liability has been resolved. Georgia Sales Tax Due Amount shown on line 6 minus amount shown on line 7. For the 2020 tax year the short-term capital gains tax rate equals your ordinary income tax rate your tax bracket.

Levies are different from liens. Serving also as an agent for the state of Georgia the tax commissioner registers and titles motor vehicles and disburses associated revenue. You have several different payment methods for covering your annual property taxes.

I am putting house up for sale and would love me to know if there are any liens on property located at 2306 Sheriff Drive in Grand Prairie Tx 75051. The Department will mark an entry of satisfaction on the execution docket and cancel the lien with the Clerk of Superior Court in each county where the lien had been recorded. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100.

Merri Tripp Thornton says. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

The three major credit reporting agenciesEquifax Experian and TransUnionremoved tax liens from their credit reports as of April 2018. A law grants the lien right when the borrower fails to pay the debt. Long-Term Capital Gains Tax in Georgia.

A federal tax lien comes into being when the IRS assesses a tax against you and sends you a bill that you neglect or refuse to pay it. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes. Liens like mechanics tax and student debt liens arent voluntarily and the lienholder doesnt need to win a judgment to get one.

Zillow has 57 homes for sale in Cairo GA. Personal checks business checks 3rd party checks money orders and debitcredit cards will not be accepted if the property has been scheduled for tax sale. If youre interested in tax lien investing the first step is finding tax liens for sale at auction.

A lien is a legal right granted by the owner of property by a law or otherwise acquired by a creditor. Your local tax agency may be able to provide information on when tax lien auctions take place according to the National Tax Lien Association NTLA. Following a tax sale any overage of funds known as excess funds is placed in a separate account.

Also in the event of a foreclosure your tax lien results in you successfully acquiring the property. A levy is a legal seizure of your property to satisfy a tax debt. IRS liens tax liens mechanic liens bank liens HOA liens personal liens and more.

6 at 10am and will be held at the DeKalb County Courthouse steps in Decatur. Learn about tax liens in bankruptcy. DeKalb Tax Commissioner.

Cash cashiers check ACH or bank wire transfer. Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Once you know when a tax lien auction is scheduled you can plan to attend.

48-4-5 excess funds may be claimed by the record owner of the property at the time of the tax sale by the record owner of each security deed affecting the property and by any other party having any recorded equity interest or claim in such property at. The Tax Collectors Office accepts payment by credit card at a 228 convenience fee and by debit card for a 395 flat fee. A lien serves to guarantee an underlying obligation such as the repayment of a loan.

Registration is required for each tax sale. Tax Due Amount Amount on line 3 multiplied by sales tax rate on line 5. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the.

After a garnishment the most common type of collection tactic by judgment creditors involves putting liens on real estate. A tax lien sale is when the liens are auctioned off to. Georgia Sales Tax Rate in Purchasers County 6.

When this happens creditors may be able to force the sale of the property and use the proceeds from the sale to pay off the outstanding judgment. Both represent sales of homes with unpaid property taxes. Liens on Real Estate.

September 22 2017 at 435 am. Purchasers Georgia County of Residence. A lien is a legal claim against your property to secure payment of your tax debt while a levy actually takes the property to satisfy the tax debt.

Tax sales and more specifically tax deed sales are not as complicated as you may first believe. After a creditor is awarded a civil judgment in court. Understanding Penalty Interest.

A federal tax lien exists after.

279 Highland Boulevard Highland Park Highland Brooklyn

State Directory Tax Sale Resources

1909 Mission Revival Bloomington Il 199 900 Old House Dreams Old House Dreams Building A House Old House

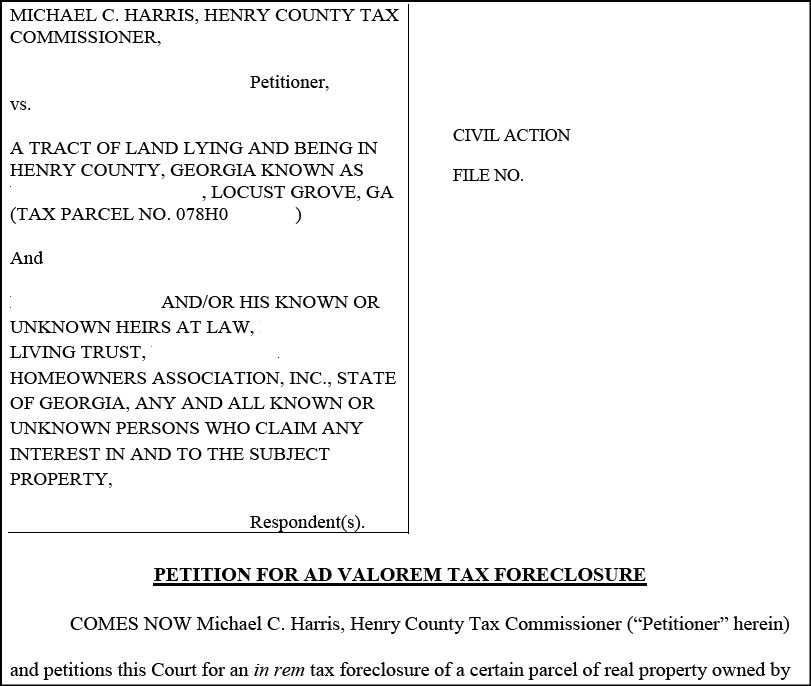

Tax Commissioner Tax Sale List

One Acre In Georgia Almost 4 000 Square Feet Has Elevator 199 000 The Old House Life

Sold Porch Goals On Seven Acres In Georgia Circa 1930 289 000 The Old House Life Old House Built Ins Historic Home

Vincent Allen Project Archives The Old House Life Old Things Updating House Old House

My Real Estate Chat Paper Bag Walls Real Estate Tips Real Estate

What Is A Tax Sale Property And How Do Tax Sales Work Home Buying Sale House Real Estate

Tax Deed Archives Gomez Golomb Law Office

Unpaid Property Tax Bills Cost Richmond County

Spanish Mission Style Bungalow Circa 1926 In Brunswick Georgia 238 800 The Old House Life Bungalow Interior Exterior Doors Mission Style Homes

State Directory Tax Sale Resources

3 Tips To Sell A Home Fast Includes A Professional Stater And Photographer Selling House Sell My House Home Selling Tips

Real Estate Bird Dogs Wanted Attention All Real Estate Bird Dogs My Company Is Willing To Pay You To Wholesale Real Estate Real Estate Ads Real Estate Leads

State Directory Tax Sale Resources

Just Reduced Gorgeous Converted Bus W New Engine Converted Bus For Sale In Tampa Florida Tiny House Listings